If one is to describe the stock market in a brief and concise manner, the word that would be fitting is “volatile.”

Things change so fast in the stock market. This is because of many factors in the corporate world. You, as an investor, would have to always be in the lookout for possible price changes so you can take appropriate actions.

Now, the question is – how can you tell which stock is ailing? What are the four signs that you should be watching out for?

Negative Cash Flow

Negative cash flow is simply a term applied to a situation which has a company spending more cash than what it earns. It’s easy to look out for – companies periodically file quarterly or annual reports with financial statements that you can download for free from the appropriate monitoring like the Securities and Exchange Commissions in the United States.

Possible situations of negative cash flows include major investments made right after a profit report. For example, a manufacturing company makes significant profits and then invests in a new factory somewhere in the globe. There’s a possibility of a negative cash flow as it will take time before the company can see returns from such a large investment.

Dangerous Debt Levels

Debts are normal in business, as some companies will need to issue bonds or physically borrow money to finance its operations. We all know that debts come with a cost, and that is, interest. The best indicator to look at is what we call the debt-to-equity ratio, which measures a company’s risk for bankruptcy in the future.

You know the drill – if the company spends too much money repaying debts, it’s going to be leaning dangerously close to being unable to sustain itself in the long-term. You’d have to keep monitoring the company so you can tell when it’s time to pull their stocks from your portfolio.

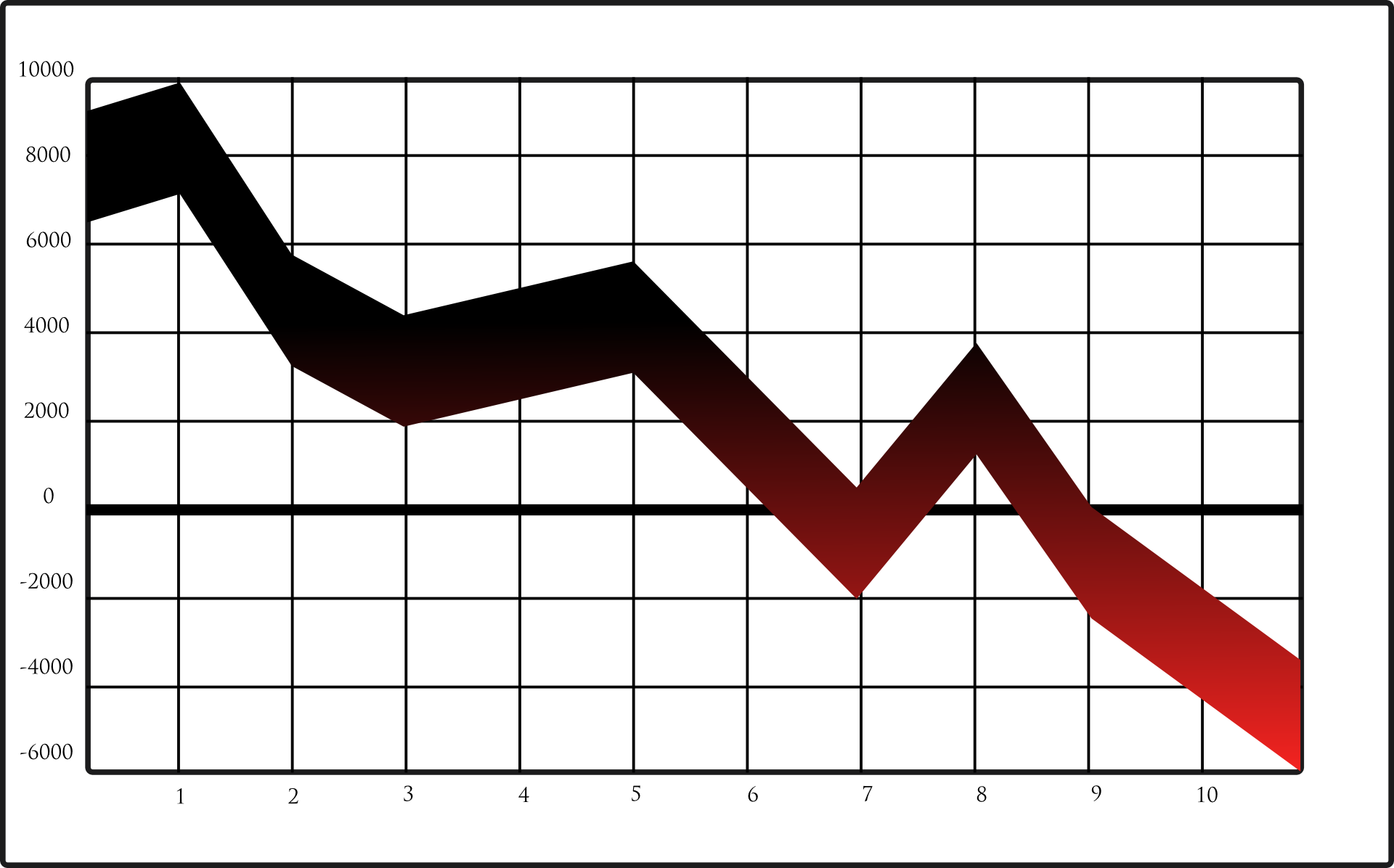

Significant Reductions in Share Price

If a company’s stock price plummets at a rate that exceeds normal, then it’s another warning sign that you might have to bail out on that stock. If you look at the history of companies that bit the bust like Enron, you’ll notice that price decline is always a first indicator of almost all company cashes.

However, there are some cases that a company’s price falls because of speculation that proved to be unfounded. You’d have to keep a closer eye on your investments to determine if that is the case, or bankruptcy. If a company is experiencing price reductions but is actually poised for a major positive change, it could be an opportunity to buy stocks at a lower cost.

Formal Inquiries and Investigations

Finally, if a company is under investigation by the Securities and Exchange Commission or any other regulating body, it should ring alarms in your head. Let’s take Enron for example. Before it declared bankruptcy, the company made use of illegal accounting methods to keep investors from pulling their investments by hiding their significant losses.

This has caught the attention of the SEC which immediately launched an investigation and discovered the true extent of Enron’s dire financial situation.

If you see any of these four warning signs involving the company that issued stocks you’ve invested in, you should pay more attention so you’ll know when it’s really time to plug the plug on your investment.