If you want to engage in international trade, one of the terms that you should take time to understand is the “tariff.” Companies who engage in supply and distribution are the ones that usually encounter the tariff, or what is alternatively called as ‘customs tax duty, but every entrepreneur would find it to his best interest to understand this concept.

What are Customs Duties?

Simply put, customs duties, as tariffs are sometimes called, are fees imposed on foreign products that are imported by a specific country upon entry into that nation. Say, a company in Australia sends a shipment of steel to Thailand. If there is an existing customs duty imposed on Australian steel according to Thai law, then the company will have to pay the tariff in order for the goods to clear customs and go to their recipients.

How are tariffs calculated? Like any tax, tariffs are imposed as a percentage of the total value of the foreign product. There is no world standard on import tariffs, so every country charges different rates for imported products that enter their jurisdiction. For example purposes, if Thailand charges a 10% tariff on Australian steel, the company that exported the steel to Thailand will have to pay $10,000 if they have shipped $100,000 worth of steel.

What Purposes Do Tariffs Serve?

Tariffs actually play a big part in any country’s trade policy. They serve different purposes, including the following:

- To generate revenue for a government

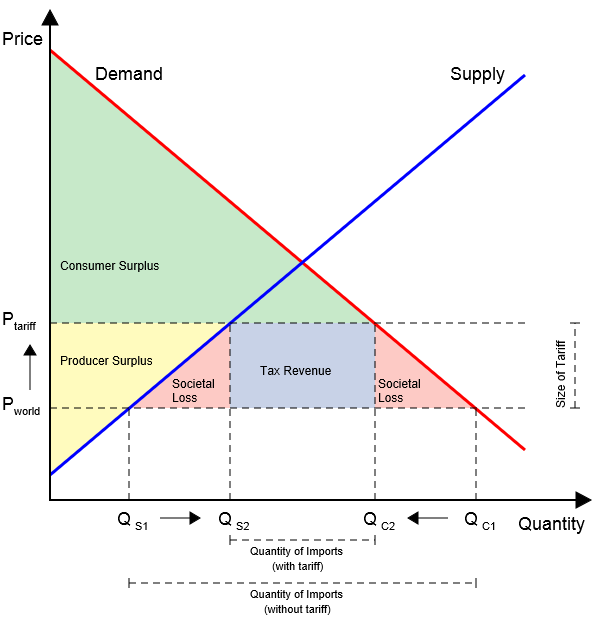

The first purpose that tariffs serve is to create additional income for any government. Governments levy taxes in order to create the necessary funds to provide essential services and to finance any development on infrastructure, after all.

- To protect locally-made products

If a specific country wants to protect locally-made products in a market that it thinks will favor foreign-made goods, then it will charge a tariff in order to make the foreign product more expensive than the local ones. This is to help promote sales for local products, as a secondary purpose to generating government revenue.

- To protect consumers from potentially hazardous products

In some cases, governments will impose unusually high taxes on items that have been pegged as potentially hazardous to consumers. The high taxes and expensive prices that result could discourage sales of that possibly dangerous product in the market.

Free Trade Agreements

There are cases that certain imported products may not be subjected to tariffs at all, or could be levied only a small percentage of tax. This is when the two countries that traded the products are signatories in a mutually beneficial free trade agreement.

Continuing with our example, the Thailand-Australia Free Trade Agreement has practically eliminated almost all tariffs on Australian steel products that enter Thailand. Slab steel from Australia, for instance, was previously subject to a 1% but the signing of the FTA eliminated that tariff immediately.

Other tariffs on steel products were first halved and then gradually eliminated since the FTA became effective in 2005. The imposed tariffs on hot-rolled coil, cold-rolled coil and coated steel products are also expected to be eliminated this year under the terms of the FTA.