Thailand offers all the elements a foreign investor would look for – inexpensive and hardworking workforce, an emerging bullish economy, a burgeoning domestic market and a supportive government in terms of economic liberalization and growth.

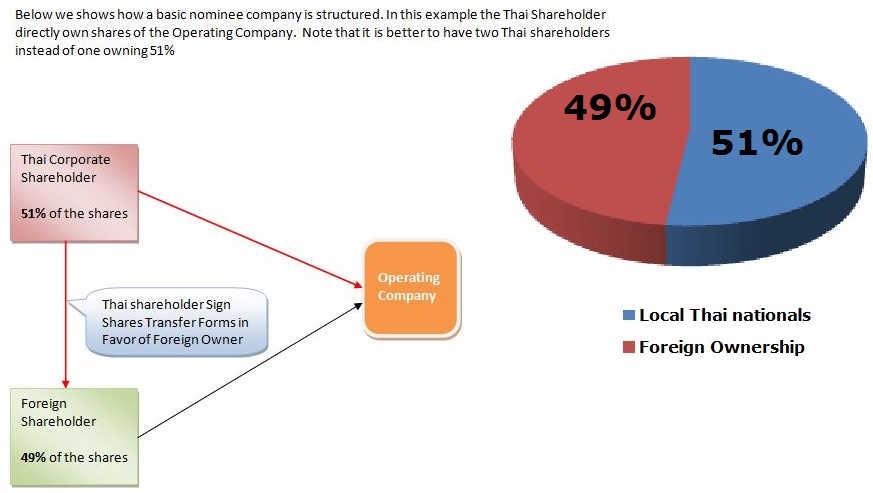

The driving force behind Thailand’s unprecedented economic growth is foreign investment with the government supporting and encouraging foreign investors from Japan, Singapore, Europe, United States, Hong Kong and Taiwan. Japan is currently the largest stakeholder in foreign investment in Thailand. And while the country presents significantly favorable conditions to lure foreign investors in the country, the major setback is the country’s policy on majority foreign ownership which is restricted to 49%, giving away the majority ownership of 51% to local Thai nationals. Additionally, foreigners need to have Board of Investment (BOI) promotion for their business activities in Thailand.

Despite the restrictions, a lot of foreign investors have shown interest in operating business in Thailand, encouraged by the country’s promise of a good business setting that will be beneficial to both the investors and Thailand’s economy. And with foreign investment coming in, foreign investors need to have preliminary consultations with either an accounting firm or law firm in Phuket to understand the conditions, rules, policies and laws, surrounding the formation of a company in Thailand. Investors need to get familiar with certain BOI rules covering their privileges if satisfying the criteria for BOI promotional activities. Company registration Phuket style may sound simple, but in reality has a lot of documentation compliance.

The BOI is mandated by the government as the principal government agency for encouraging investment. They are tasked with devising and implementing strategies under which promotional activities are organized. The approval of foreign business activities in Thailand comes from the BOI. They, together with the Ministry of Commerce are tasked to give the approval for foreign investment applications under the BOI promotional activities.

Additionally, the BOI has the power, exercised on a case by case basis, to grant fiscal and other promotional incentives to Thai registered companies which can include the following rights: majority foreign ownership; ownership of land and buildings; exemption from import duty on imported raw materials and machinery used in the promoted business; and exemption from corporate income tax for up to eight years.

BOI Criteria for Project Approval

- For projects with investment capital not exceeding Baht 500 million (excluding the cost of land and working capital), the following criteria are used:

- the value added is not less than 20% of sales revenue, except projects that manufacture electronic products and parts or processed agricultural produce, and projects granted special approval by the Board;

- ratio of liabilities to registered capital should not exceed 3 to 1 for a newly established project. Expansion projects are considered on a case by case basis.

- a promoted project shall be required to use modern machinery and production processes. In cases where old machinery will be used, its efficiency must be certified by reliable institutions and must obtain the Board’s approval; adequate environmental protection systems are installed.

- For projects with investment capital (excluding the cost of land and working capital) over Baht 500 million, a feasibility study for the project, as prescribed by the Board, must be submitted.

As long as the foreign investors comply with the criteria, rules and policies set out by the BOI pertinent to ownership requirement, financial requirement, etc., and as long as the promotional activities are deemed sound and financially benefitting the country and its economy, BOI approval will be granted without a doubt.